Reinstate TCJA tax policies to protect jobs and innovation

For the past seven years, the Tax Cuts and Jobs Act (TCJA) has made the United States a more attractive market for jobs and investment primarily by lowering the corporate tax rate from 35 percent to 21 percent while at the same time increasing the cost of earning profits in foreign jurisdictions by imposing a minimum tax, or GILTI tax rate, on all foreign income. As a result, the U.S. business tax system is more globally competitive, helping to foster healthcare innovation and the development of new cures.

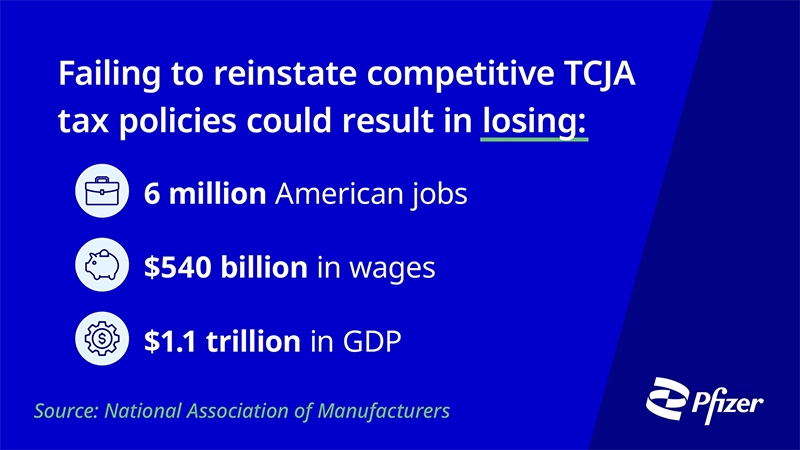

With certain TCJA policies recently expired or set to expire this year, Americans are depending on Congress to reinstate the TCJA’s pro-growth tax policies to help protect future cures and American jobs. Acting now will help protect America’s competitive edge.

Allowing TCJA Policies To Expire Could Have Devasting Consequences

Patients need Congress to reauthorize the TCJA’s competitive tax policies. Otherwise, there could be serious unintended consequences that harm the resources needed to research, develop, and produce groundbreaking treatments:

- The U.S. could become less attractive for investment.

- An increase in corporate tax rates would saddle the U.S. with an unfavorable tax regime for new investment.

- A more attractive U.S. tax environment gives companies based in both the U.S. and foreign countries an incentive to invest more capital — equipment, technology, and facilities — in our country.

- Raising corporate taxes could drive investment and jobs overseas.

- The American workforce could suffer.

- When globally engaged U.S. companies can compete on a level playing field with their foreign-owned counterparts, the American worker wins.

- Success in foreign markets allows U.S.-based companies to expand at home.

- U.S. progress in global competition could be reversed.

- For future cures to be developed in the U.S., American companies must be able to compete with foreign competitors.

Congress Must Act by the End of 2025 To Protect Jobs, Growth, and Innovation

By preventing pro-growth TCJA tax policies from expiring and preventing any new anti-competitive provisions from coming into effect, policymakers can help preserve a competitive tax system that not only spurs job growth and the economy but also helps foster healthcare innovation and the development of new cures.

Help protect healthcare innovation and the American workforce: Reauthorize the TCJA tax policies and prevent any new anti-competitive provisions from coming into effect!