Press Releases

All Pfizer published press releases by date and/or category of news

12.17.2025

12.16.2025

12.12.2025

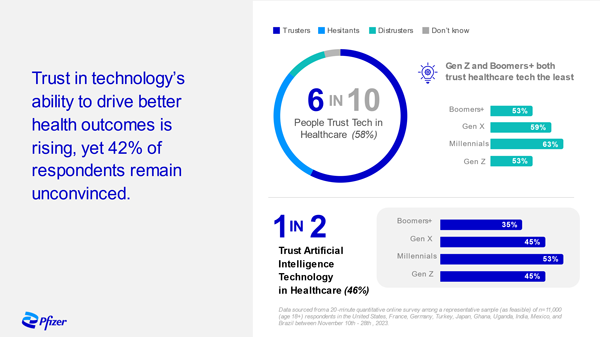

Trust in Technology – A Snapshot

Pfizer surveyed adults in 10 countries across the Global North and South to better understand the general population's trust in incorporating technology into the management of their healthcare. The results showed that 6 in 10 trust technology in this setting but that means 4 in 10 are at risk of being left behind. Our findings underscored that patients won’t feel the full benefits of that technology if we don’t have trusted people – specifically health care providers – delivering it. We must partner with patients, healthcare providers, policy makers and others in the life sciences and tech industries to build trust in the technologies that are fueling the future of health.

Downloadable Infographic Details

Media Asset Library

A collection of assets for use by media.

Updates and Statements

Partnering News

The latest news from Pfizer and its strategic partners

12.01.2025

10.22.2024

Media Contacts

Pfizer Media Relations

We encourage everyone to view our press releases, press statements, and press kits to stay up to date on Pfizer news.

However, to ensure that customers, investors, and others receive the appropriate attention, Pfizer media contacts may only respond to calls and emails from professional journalists.

Media Contacts

General email

[email protected]

United States, Canada and Latin America

+1 212.733.1226

Europe, the Middle East and Africa

+44-(0)173.733.2335

[email protected]

Asia Pacific

+65.918.732.47

What we need

To best help us help you, please be prepared to provide your name and email address, a summary of the article you're working on and your deadline.

Other Frequently Visited Links

For more, see these helpful and often used sections of Pfizer.com

Pfizer Wire

Stay up to date on the latest news and alerts through the Pfizer Wire

Sign up to receive real-time updates on Pfizer’s news from the Pfizer Media Relations team delivered directly to your inbox.

Sign Up Now Details