Congress must reinstate competitive tax policies to protect jobs and innovation

Pro-growth tax policies that have fostered both job growth and healthcare innovation made the U.S. more appealing for jobs and investment. As a result, the U.S. business tax system is more globally competitive, helping to foster healthcare innovation and the development of new cures.

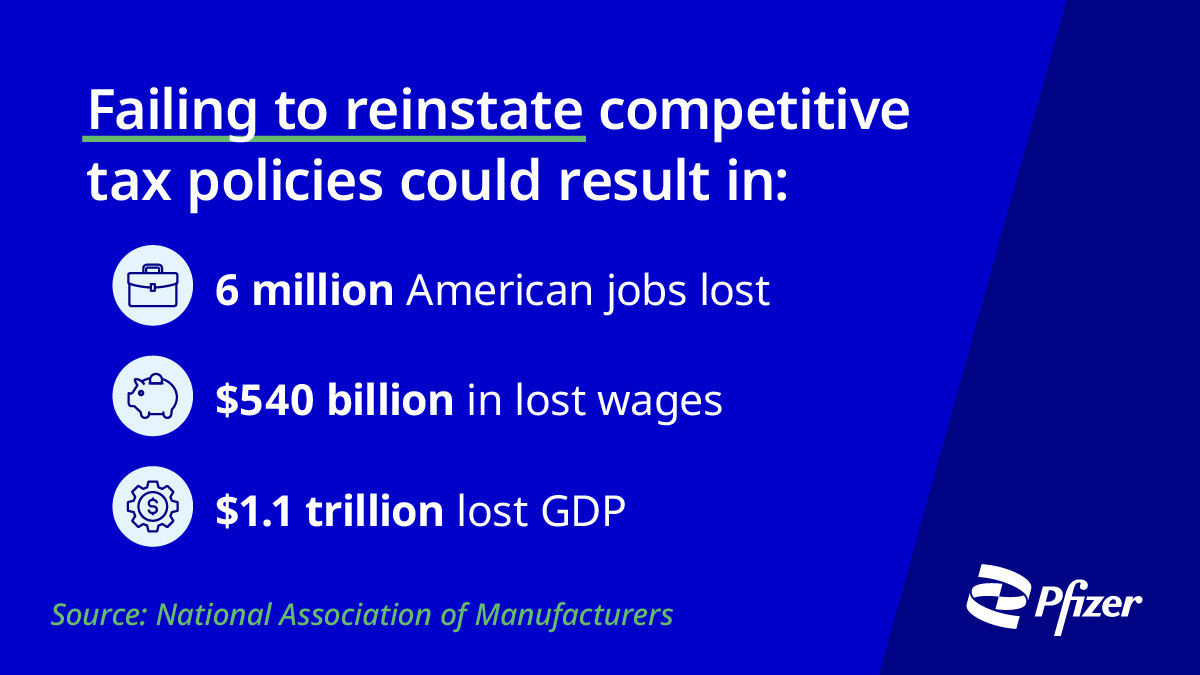

Allowing Pro-Growth Tax Policies To Expire Could Have Devasting Consequences

If Congress fails to renew pro-growth tax policies, there could potentially be serious unintended consequences that disrupt the U.S. economy, job force, and manufacturing capabilities to research, develop, and produce new groundbreaking treatments:

- The U.S. could become less attractive for investment. A competitive tax system helps encourage companies—both American and foreign—to invest in the U.S., creating jobs and strengthening our economy.

- The American workforce could suffer.

- When U.S. companies can compete fairly with foreign businesses, the American worker wins.

- Success in global markets allows American businesses to grow and create more jobs here at home.

- U.S. progress in global competition could be reversed. To keep America strong and competitive, we need policies that attract investment, support job growth, and ensure U.S. businesses can succeed on the world stage.